Jom jimat!

HR training courses that directly benefit your business.

Up to 100% HRDF-claimable.

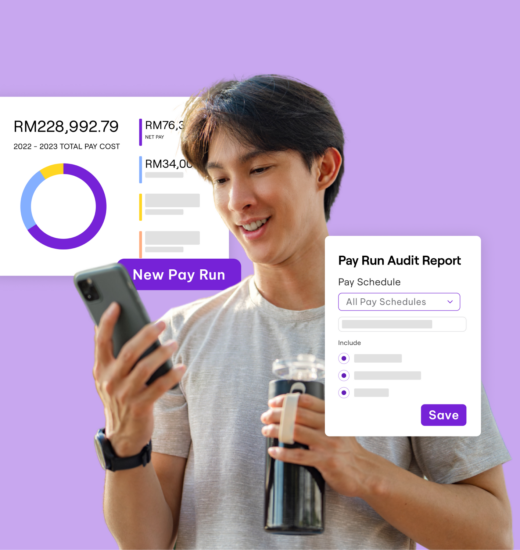

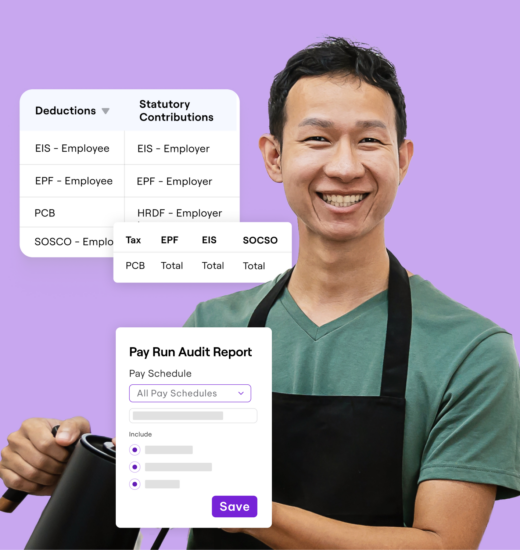

Employment Hero is officially a HRD Corp Registered Training Provider, which means you can offset up to 100% of your training costs when you adopt our all-in-one HR and payroll software today!

Make the most of your HRDF levy contributions before they expire in 2

years, and take recruitment, employee engagement and more to the next level.

Results that speak for themselves.

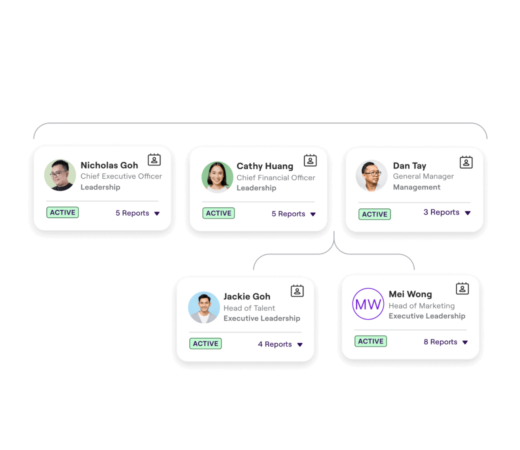

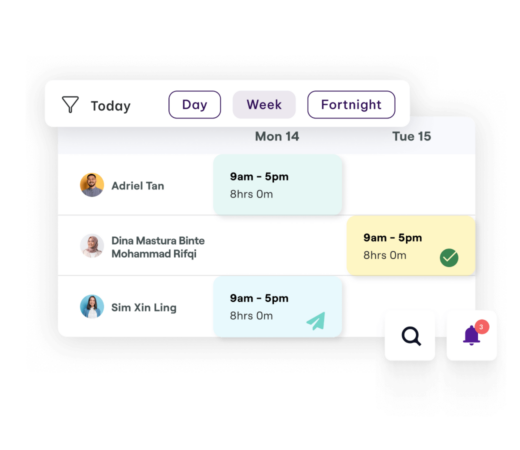

We're here to make HR easy.

Hear from our happy customers.

Did you know that your HRDF levy expires in 2 years?

Any unused amount will be forfeited, so why let it go to waste?

Our platform helps you streamline HR processes and boost productivity, which directly benefits your business operations and supercharges it for growth. From elevating your performance reviews to fostering stronger employee engagement, we’ve got you covered.

Eligibility criteria for the HRD Corp Grant

You can apply for the HRD Claimable Courses Grant if your business meets the following criteria:

- Your business is registered and operating in Malaysia

- Your business is registered with HRD Corp (mandatory for organisations with more than 10 Malaysian employees, optional for organisations with 5-9 Malaysian employees)

- Your business contributes to the HRDF levy (1% per employee per month for organisations with more than 10 Malaysian employees, 0.5% per employee per month for organisations with 5-9 Malaysian employees)

- Your business has no levy arrears or levy interest pending payment

- The training course content must be in areas that bring about direct benefits to your business operations

- The training provider is HRD Corp registered and approved (that’s us!)

How to claim your training fees from HRDF?

- Speak to us for a customised quote based on your business size and needs.

- Before training commences, submit your grant application via e-TRiS along with all the supporting documents needed.

- Upon approval from the Grant Officer, pay your Employment Hero invoice in full and proceed with training.

- Once training is complete, employers may apply for reimbursement through e-TRiS.

Take your business to the next level

AI. For Everyone.

Our suite of artificial intelligence (AI) features are designed to streamline your workday, freeing you up to do what computers can’t. From finding the right words to recognise your co-workers to writing job descriptions and interview notes, we’ll help you do it all in just one click.

FAQs

The HRD Corp Claimable Courses Grant is a programme that lets employers make use of the Human Resources Development Fund (HRDF) levy for employee skills development. Eligible SMEs can offset their employee training costs as long as the training course is relevant to their business operations.

Employment Hero has officially been approved as a registered training provider by HRD Corp. Companies and organisations that are HRD Corp Registered Training Providers can act as a Training Vendor to HRD Corp Registered Employers. That means eligible SMEs can claim up to 100% of their training costs for Employment Hero’s all-in-one HR and payroll software, offsetting the costs with their HRDF levy balance.

No, unlisted vendors who are not approved by HRD Corp participate cannot participate in the HRD Corp Claimable Courses Grant. This grant requires businesses to work with HRD Corp vendors to ensure the quality and reliability of the training provided.

HRD Corp’s assessment process involves vetting training vendors to ensure they meet specific standards and criteria. This verifies that they are competent and skilled in their area of specialisation, and that they are best equipped to provide quality training for professional development.

Yes, there is. The amount claimable depends on a business entity’s HRDF levy balance. In addition, according to the PSMB Act 2001, if the HRDF levy is not utilised within two (2) years, any levy amount above RM10,000 is forfeited.

If your organisation’s HRDF levy balance has been exhausted, it will no longer be eligible to receive further funding for additional training until the fund balance has been replenished. You should carefully plan your HRDF levy utilisation to maximise the benefit within fund limits. If additional funding is needed beyond your HRDF levy balance, you will need to explore other grants or financing options.

According to HRD Corp’s employer guidelines, all training grant applications will be processed within four (4) working days provided the documents submitted are complete. Letters of approval will be sent to employers via email after the claims have been approved.

Claim disbursements take up to eight (8) working days to process.

The funds will be disbursed through the e-Disbursement system. You can register for e-Disbursement through the e-TRiS platform.